Introduction

For many retirees aged 65 and older, health insurance can feel like a maze of confusion, fear, and frustration. This fear is often amplified for those managing chronic health conditions or feeling overwhelmed by the complexity of Medicare. This guide is here to help reduce that fear by breaking down Medicare in a way that makes it understandable, actionable, and less intimidating. My goal is for you to feel more confident about your healthcare choices.

Understanding Medicare: The Basics

When it comes to Medicare, many people feel lost. Let’s simplify it.

Medicare Part A & B: The Core

- Medicare Part A covers inpatient hospital care, skilled nursing facility care, and some home health services. For most people, it’s premium-free because you’ve paid for it through payroll taxes during your working years.

- Medicare Part B is your medical insurance, covering outpatient care, doctor visits, and preventive services. Unlike Part A, it has a monthly premium, which varies based on your income.

Key Takeaway: Think of Medicare Part A as your “hospital or inpatient coverage” and Part B as your “doctor or outpatient coverage.”

Medicare Advantage (Part C): A Personal Choice

- Medicare Advantage (Part C) is an alternative to Original Medicare. It’s offered by private insurance companies and covers everything Part A and Part B cover but also consists of additional benefits like vision or dental.

- These plans often come with lower out-of-pocket costs but have more restrictions: such as which doctors you can see and prior authorization necessities.

Example: If you want lower monthly costs when healthy and extra benefits, a Medicare Advantage plan might be a good fit. Just be aware of network limitations—these plans may require you to use their doctors. Also, if you do get sick the Advantage plan could be a disadvantage with the higher copays for services like inpatient hospital stays.

Key Takeaway: Advantage plans can bundle benefits but could limit your healthcare options and cost more when sick or hurt in the hospital.

Medicare Part D: Prescription Drug Coverage

- Medicare Part D helps pay for prescription medications. Even if you are healthy and not on any medications, have a prescription drug plan is a requirement since Medicare will penalize you with higher premiums if you do not sign up for a prescription drug plan when you first become eligible.

Summary of Medicare Parts

| Medicare Part | What It Covers | Costs |

|---|---|---|

| Part A | Hospital Stays | Usually premium-free |

| Part B | Doctor Visits, Outpatient | Monthly premium (\$174.70 in 2024, varies with income) |

| Part C | All-in-One Plans | Varies, may include extra benefits |

| Part D | Prescription Drugs | Varies by plan can include penalties for late enrollment |

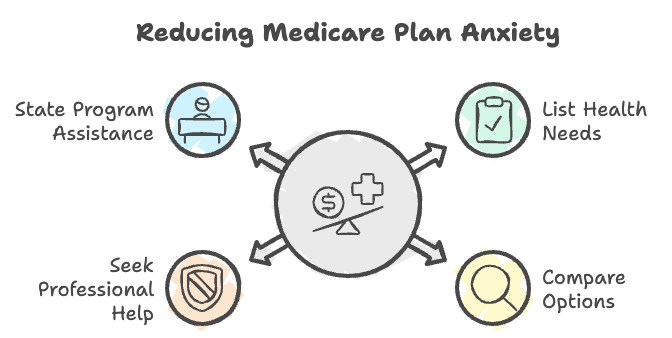

How to Reduce the Fear of Choosing the Wrong Plan

Choosing a Medicare plan can be overwhelming. But here’s a simple way to tackle it:

- List Your Health Needs: Write down your current medications, doctor visits, and treatments you need regularly.

- Compare Options: Use Medicare’s plan comparison tool to look at different options side-by-side. Make sure to consider your specific health needs.

- Ask for Help: You’re not alone. Licensed insurance agents can compare plans for you without extra cost. Consider contacting an experienced and educated insurance broker who can help explain details and give you options for plans available to you. They can also assist you with signing up and be your agent of record, advocating for you when you are on Medicare.

- You can also reach out to your State Health Insurance Program through the Office of Aging. They have unbiased, trained, and trustworthy advisors who can answer your questions, provide plan options, and guide you through the sign-up process.

Case Study: Maria’s Journey to Medicare Confidence

Maria, a 68-year-old retiree, has Type 2 Diabetes and hypertension. She was scared of choosing the wrong Medicare plan, worried about high costs for her insulin and doctor visits. With Medicare Part B at almost \$200 a month she was worried she couldn’t afford Medicare. Maria began by writing down all her prescriptions and identifying the specialists she visits. With this information in hand, she worked with an insurance broker who helped her pick a Medicare Advantage plan that was no additional monthly cost to her and it covered her medications with a manageable drug prices at the pharmacy.

Key Takeaway: Personalized help can make Medicare choices feel less daunting and prevent costly mistakes.

Medicare Supplement Plans (Medigap): Is It for You?

If the unpredictability of medical costs scares you, a Medicare Supplement Plan (Medigap) might be what you need. Medigap plans help cover costs like co-payments and deductibles that Original Medicare doesn’t.

- Pro: Predictable expenses for medical care.

- Con: Higher monthly premiums, but fewer unexpected costs.

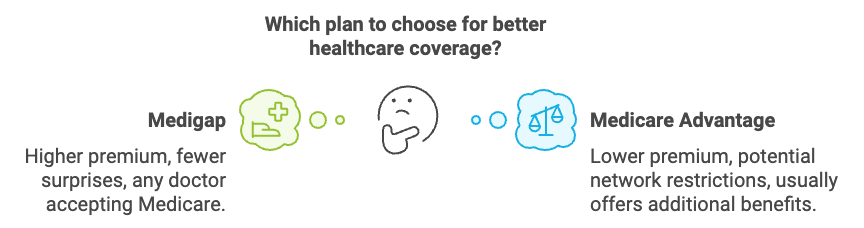

Medigap vs. Medicare Advantage

| Feature | Medigap | Medicare Advantage |

|---|---|---|

| Cost | Higher premium, fewer surprises | Lower premium, potential network restrictions |

| Flexibility | Any doctor accepting Medicare | Limited to network |

| Additional Benefits | No (focused on medical expenses) | Usually offers dental, vision, etc. |

Why Trust Is Important

Many people fear insurance because they don’t know whom to trust. Medicare ads can be misleading, and it’s hard to know if you’re getting an unbiased recommendation. Here’s how to take control:

- Look for Licensed Experts: Always work with a licensed Medicare advisor. They are required to act in your best interest.

- Instructions to find out if your Insurance Agent is licensed.

- Be Skeptical of TV Offers: If a plan sounds too good to be true, it probably is. Most TV ads highlight “free” benefits without mentioning the potential downsides, like restricted doctor networks.

- Research Your Options: Use Medicare’s official site (Medicare.gov) to verify what plans are available in your area. Trust but verify.

Fear of High Costs: How to Manage It

A common fear is that healthcare costs will spiral out of control, especially when managing chronic conditions. Here’s how to manage this:

- Budget for Healthcare: Set aside a monthly budget for premiums and medications. Understand that unexpected medical costs can happen, but Medigap plans can help cover these expenses.

- Get Extra Help if Needed: Some retirees qualify for “Extra Help” to pay for prescription drug costs. This federal program is underused because many don’t know about it! Check out what it takes to qualify for Extra Help with the Federal Government.

Practical Example: John, 70, was surprised by high prescription costs. He applied for “Extra Help” and saw his medication costs drop from \$150 to \$20 a month. Look into this if your income is limited—it can save you significantly.

Understanding the Costs Without Fear

Medicare isn’t entirely free. Knowing what to expect can help ease your fears:

- Monthly Premiums: Part B costs money each month. For 2024, the standard premium is \$174.70.

- Deductibles and Co-pays: You’ll have deductibles and copays or coinsurance for hospital stays and doctor visits. The more you understand these numbers, the less shocking they become. Depending on your supplement plan or advantage plan these deductibles and copays will change. Another good reason to speak with someone experienced in insurance.

Key Takeaway: Knowing your costs upfront prevents fear from taking over.

Take Control: Making an Empowered Decision

When facing fears about healthcare, the best approach is to get informed. The more you know about how Medicare works, the better choices you can make for your health.

- Challenge Assumptions: Don’t assume you’re stuck with one choice. If you don’t like your plan, you can change it during open enrollment.

- Ask Questions: Ask your doctor or Medicare agent about costs. The more transparent they are, the better you’ll feel.

Common Myths about Medicare—Busted

- Myth: “I don’t need Part B if I’m healthy.”

Reality: 1. If you don’t sign up for Part B when you are eligible and you wait Medicare will tack on a penalty to your Part B monthly premium. Better to sign up when you are eligible than pay the price of waiting. 2. Preventive care is covered under Part B, which means you’re better prepared for unexpected health issues. - Myth: “Medicare covers all my healthcare costs.”

Reality: There are out-of-pocket expenses even if you have a Medigap plan or a comprehensive Medicare Advantage plan.

Key Takeaway: Not understanding Medicare can be costly—financially and emotionally.

Conclusion: Your Health, Your Rules

Taking control of your health insurance can reduce fear and make you feel empowered. Medicare might seem confusing, but by breaking it down, knowing your options, and asking for help, you can make a choice that benefits you. Whether you’re managing a chronic condition or just want coverage you can count on, knowledge is power. Don’t let fear dictate your health decisions—inform yourself, take charge, and feel confident in your Medicare plan.

How do you feel now?

If you’re still feeling unsure, take the first step by calling a licensed Medicare advisor or visiting Medicare.gov for more details. The time you spend today learning about your options could save you from stress and unexpected costs in the future.

I am a licensed Medicare broker in several states and am happy to help answer questions or put you in touch with an agent near you. Call me at 770-532-1900 ext 108 for Sarah Christly.