My father did not know that once my mother retired and he no longer had her insurance through her employer, he needed to sign up for Medicare Part B. Unfortunately, because he missed this critical detail, he ended up with thousands of dollars in medical bills that could have been covered by Medicare if only he had the proper information, this information!

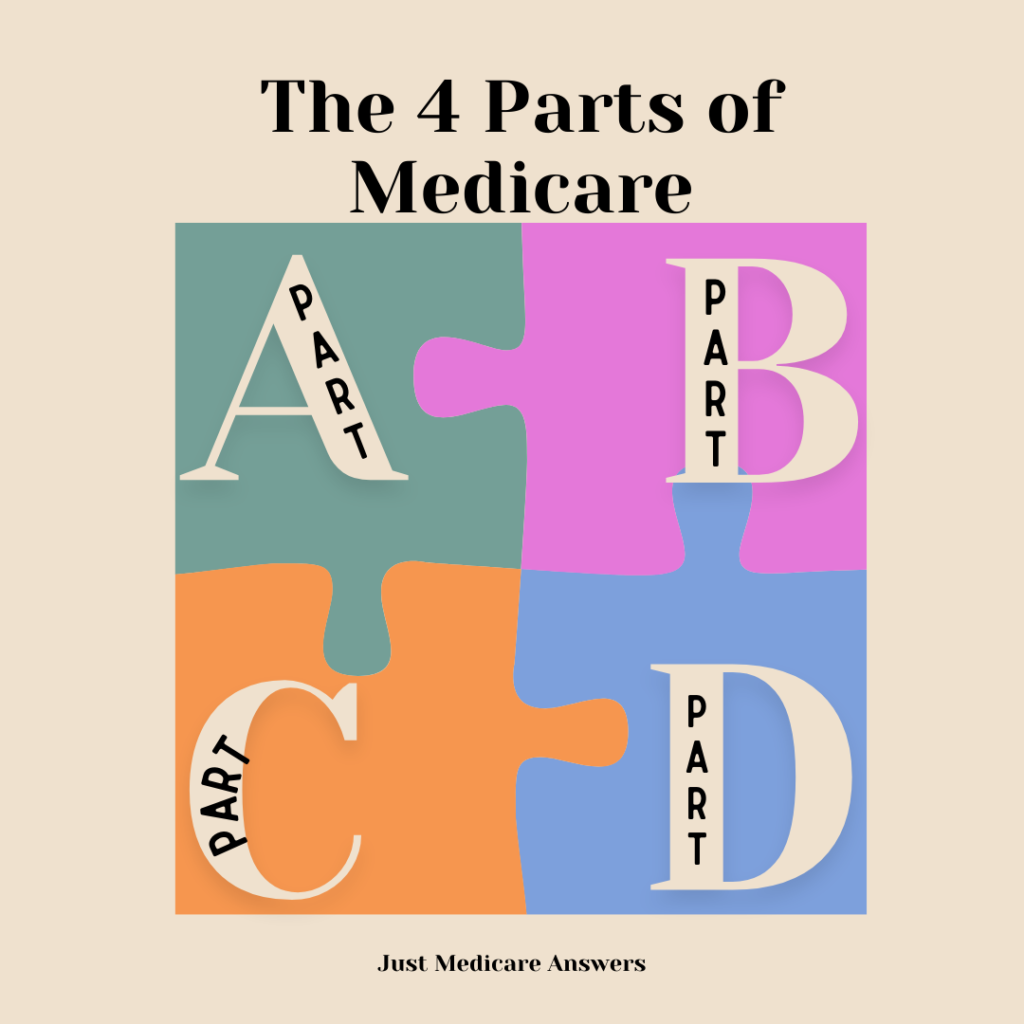

Medicare has different “parts,” Each letter A-B-C-D is a part to the whole of Medicare, and sometimes it’s sort of confusing. Each part covers something different related to health care. Here’s an overview to help you understand exactly what each part covers and why it would be important to you.

Medicare Piece by Piece

Most people think of Medicare as one big program that covers everything. That is not the case. In reality, it’s broken down into four parts, each designed to serve a different need. Not understanding how the parts interact with one another may inflate your costs or deprive you of necessary medical coverage when you need it.

It’s intimidating to think about all of Medicare. Part A, Part B, Part C, Part D—it sounds like some sort of puzzle with no instructions. What does each part cover? Why are there so many parts in the first place? Which should you choose and what happens if you choose the wrong one? If you did, unfortunately, that might mean you receive unexpected medical bills. You have to make the right decisions, or you could end up out-of-pocket for something that really should have been covered by Medicare.

Medicare Part Summary:

Part A

Part A covers inpatient hospital stays and care in a skilled nursing facility. You typically won’t have to pay a premium for Part A because it’s already been paid for through payroll taxes during your working years.

Part B

Part B covers doctor visits, outpatient care, and certain preventive services. This is especially important if you visit your doctor regularly, need medical tests, or have outpatient surgeries. Unlike Part A, you will need to pay a monthly premium for Part B, but it’s a worthwhile investment in maintaining your health.

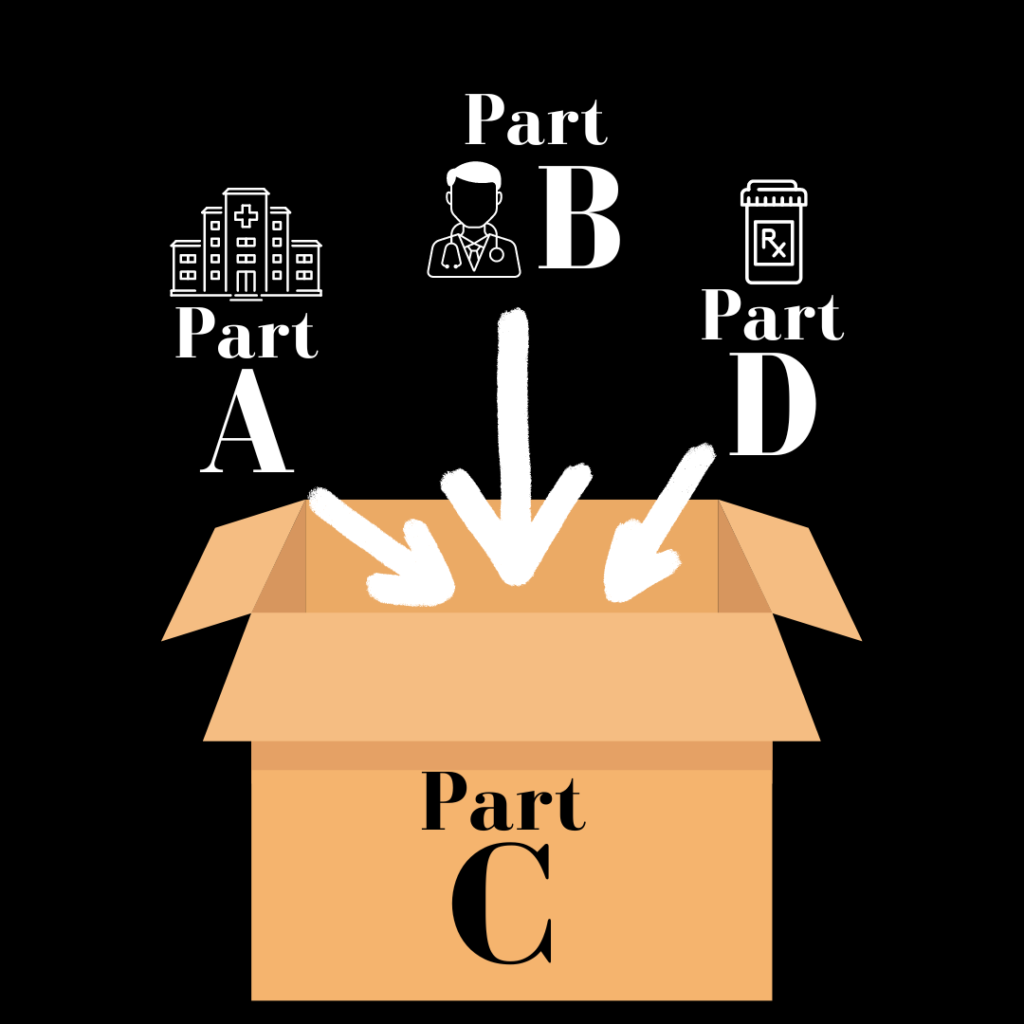

Part C

Part C, also known as Medicare Advantage, combines Part A and Part B, and often Part D. These plans are offered by private insurance companies and may include extra benefits not covered by Original Medicare, such as dental, vision, and hearing care.

Part D

Part D is for prescription drug coverage. If you take medication, Part D helps manage those costs. It’s important to note that Part D is often included in Medicare Advantage plans, but it can also be purchased separately if you have Original Medicare.

It may seem complicated, but understanding how these components fit together will help you ensure that you get exactly the coverage you need.

Need More Help?

If you’re still confused as to how to enroll, avoid penalties, or find what is best for your needs, I have more information on my website. You can also connect with me for personalized assistance: text or call me at 404-225-6331 or email me at sarah@tis-ga.com. Keep watching for my next video as I will explain Medicare Parts in great detail, in an easy-to-understand way.